Business Insurance in and around Baton Rouge

Calling all small business owners of Baton Rouge!

Cover all the bases for your small business

Help Protect Your Business With State Farm.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide terrific insurance for your business. Your policy can include options such as extra liability coverage, worker's compensation for your employees, and a surety or fidelity bond.

Calling all small business owners of Baton Rouge!

Cover all the bases for your small business

Strictly Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Cliff Ourso, Jr. for a policy that covers your business. Your coverage can include everything from extra liability coverage or worker's compensation for your employees to professional liability insurance or employment practices liability insurance.

Call Cliff Ourso, Jr. today, and let's get down to business.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

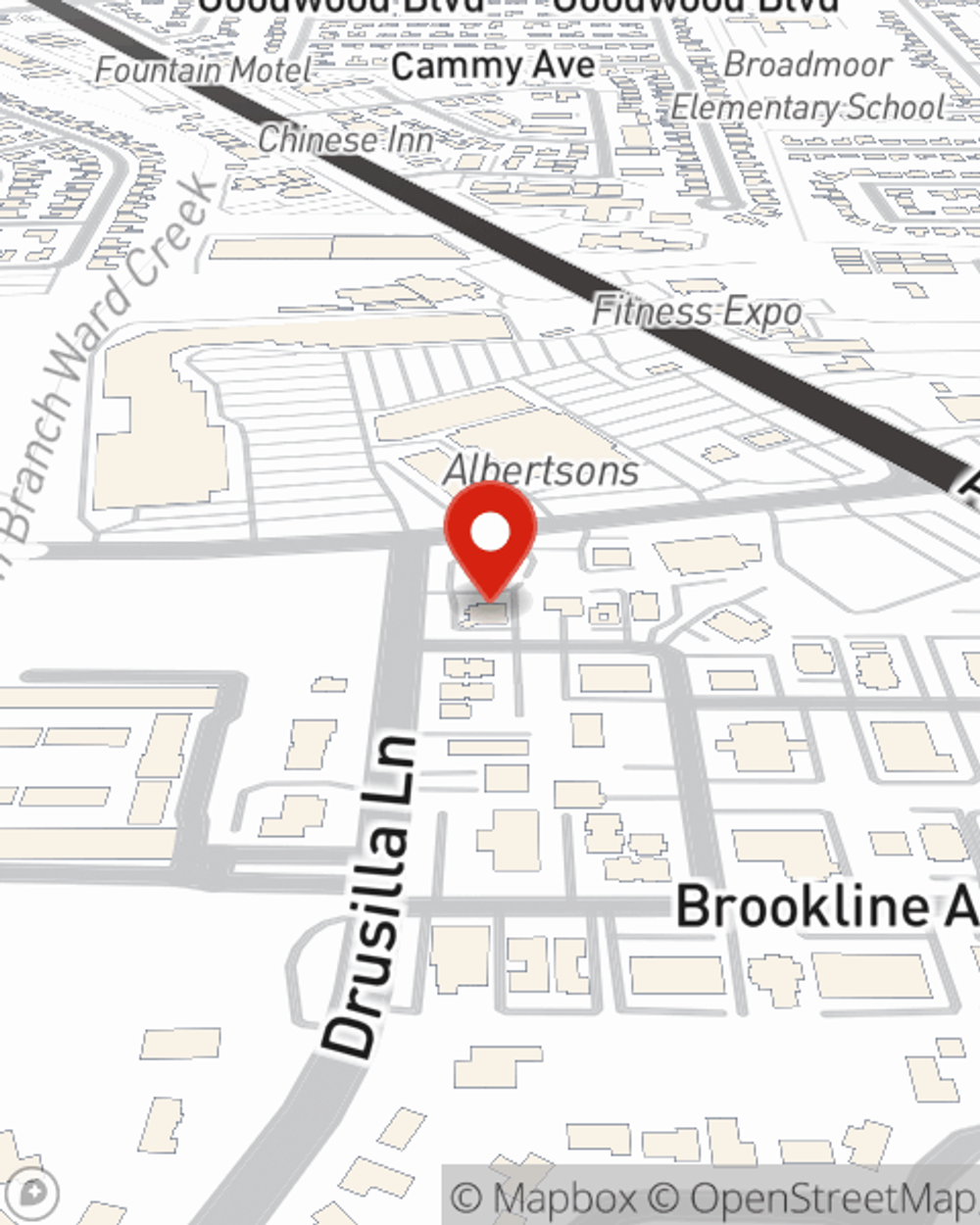

Cliff Ourso, Jr.

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.